If you’ve been working in Japan for a while, you’ve probably noticed a flurry of emails from HR as the year winds down about nenmatsu chosei (年末調整).

Nenmatsu chosei is a year-end tax procedure in Japan where your employer calculates your final income tax for the year and adjusts for any overpaid or underpaid amounts. Going through this process can feel overwhelming: there are multiple documents to fill out, fields to complete, and terminology that might be entirely new. But despite the initial stress, this is actually designed to work in your favor. By reconciling the income tax your employer has withheld throughout the year with your actual tax obligations, you can ensure you don’t overpay, which sometimes even leads to a refund.

But how do you fill them out? In this post, we’ll explain what the year-end tax adjustment is, why it matters, and how you can file your year-end tax adjustment declaration. We’ll also go through some of the common documents you might encounter and explain their Japanese terminology!

This article is for educational purposes only and is not tax advice. For official information, please refer to the National Tax Agency or consult a qualified tax professional.

What is Japan’s Year-End Tax Adjustment: Nenmatsu Chousei

When you work for a company in Japan, you’ve probably noticed that health insurance, pension contributions, and income tax are automatically deducted from your paycheck. This is part of Japan’s tax withholding system, where employers are required to withhold a portion of your salary each month and pay it directly to the government. It’s a way to make sure taxes are collected steadily throughout the year.

The principle of year-end tax adjustment in Japan is quite simple. Since the income tax from your salary is based on an estimate of your annual income, at the end of the year (usually in December), your employer reviews your total earnings, deductions, and exemptions. They then recalculate your actual tax liability.

But sometimes the amount taken out during the year isn’t exactly right. Maybe too much or too little was taken. That’s where nenmatsu chosei — the year-end tax adjustment — comes in. This process reconciles the difference. If too much tax was withheld, you get a refund directly in your next salary. If too little was withheld, the remaining tax is deducted from your salary.

Who is Eligible for Year-End Tax Adjustment in Japan (Nenmatsu Chosei)?

The baseline criterion for doing nenmatsu chousei is that you are a resident of Japan and employed by a company in Japan. This means that if you are working overseas, even for a Japanese company, or freelancing for a Japanese client, you are not eligible for the year-end tax adjustment. Similarly, if you are self-employed or a freelancer in Japan, you will not be subject to nenmatsu chousei and will instead need to file a kakutei shinkoku (確定申告), Japan’s final income tax return.

Generally, the adjustment applies to employees who have been employed for most or all of the year and who receive income only from their employer. Being a regular, wage-earning employee is essential, but there are exceptions. You might not be subject to the year-end tax adjustment if you fall into any of the following categories:

- Working for a non-Japanese company (that isn’t a Japanese branch of an overseas company).

- Being employed by multiple companies or having side jobs.

- Leaving Japan after resigning from or leaving a Japanese company before the end of the year.

- Other sources of income exceeding 200,000 JPY annually.

- Earning over 20 million JPY in a year.

Why Do You Need to Fill Nenmatsu Chosei?

At first glance, year-end tax adjustments in Japan might seem unnecessary. After all, if your income tax is deducted from your salary every month, shouldn’t the company and the government already know exactly how much you owe? The reality is a bit more complex.

First, it’s important to understand that the amount deducted from your salary each month is just an estimate. At the beginning of the year, your employer calculates tax based on your expected annual income and your dependents. But life isn’t always predictable — if your income changes, you switch jobs, receive a promotion, or experience personal changes like taking out loans or adjusting pension contributions, the monthly deductions may no longer match the exact tax you owe.

Second, there are additional factors that affect your final tax amount that the government can’t easily track in real time. These changes affect your total income for the year. Other personal circumstances, like whether you have dependents or a spouse with low income, also affect your tax liability.

This is why Japan requires employees to declare these details at the end of the year. The year-end tax adjustment ensures that your total income tax for the year is calculated accurately, helping you avoid overpaying — or underpaying — the government.

Some of the main factors that affect your year-end tax adjustment in Japan include:

1. Dependents (扶養控除, Fuyou Koujo): If you have children or elderly family members you support, you may qualify for a dependent deduction, which reduces your taxable income. The deduction varies depending on the number and age of your dependents.

2. Spouse (配偶者控除, Haiguusha Koujo): If your spouse earns below a certain income threshold, you may qualify for a spousal deduction. Even if your spouse earns slightly more than the threshold, you may still get a partial deduction.

3. Insurance Premiums (社会保険料控除・生命保険料控除, Shakai Hokenryou & Seimei Hokenryou Koujo): Payments toward health insurance, pension, life insurance, and earthquake insurance can be deducted from your taxable income. Employers usually require proof of these payments during the year-end adjustment.

4. Medical Expenses (医療費控除, Iryouhi Koujo): Significant medical expenses not covered by insurance may be deductible. This usually applies more to those filing a full tax return, but some cases can be included in the Nenmatsu Chousei.

5. Housing Loan Deduction (住宅ローン控除, Juutaku Loan Koujo): If you have a mortgage in Japan, certain repayments may qualify for a deduction, lowering your taxable income. Initial applications may be included in the year-end adjustment.

6. Donations (寄付金控除, Kifukin Koujo): Donations to qualifying organizations in Japan can also be deducted. Some employers allow these to be included in the year-end adjustment.

7. Other Income Sources: If you have multiple income sources, such as side jobs or freelance work, your year-end tax adjustment may not cover everything. In such cases, you’ll need to file a kakutei shinkoku (確定申告), Japan’s final income tax return, to accurately calculate your taxes.

How to Fill Out Your Year-end Tax Adjustment in Japan

The good news is that nenmatsu chousei is usually handled by your employer, so you don’t need to file it yourself. The year-end tax adjustment is typically submitted by January 31 of the following year.

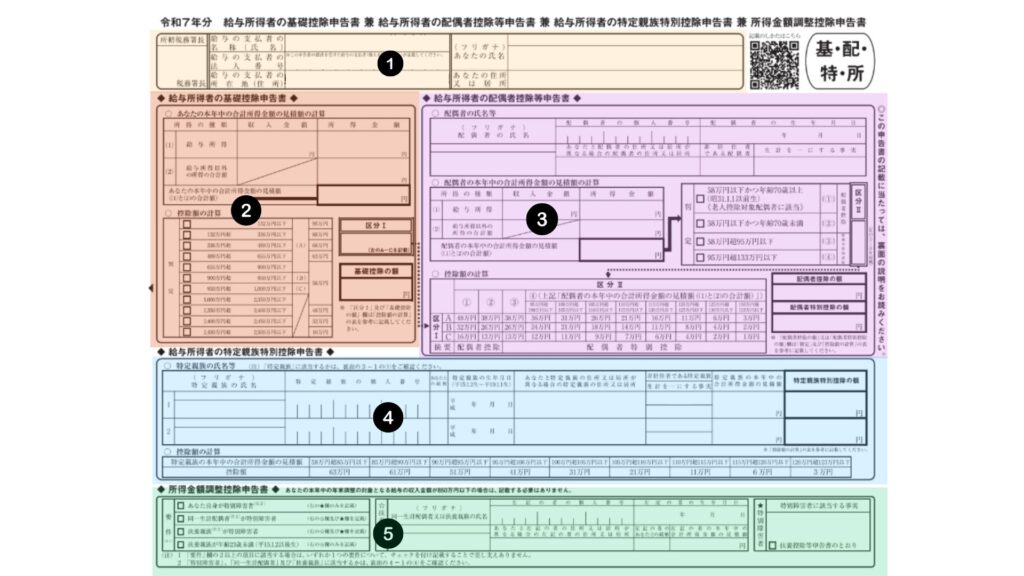

That said, there are still some details you need to provide. Generally, you’ll be given three main documents for the Japanese year-end tax adjustment. They are:

| Japanese (書類名) | Romaji | English |

| 給与所得者の基礎控除申告書・配偶者控除等申告書・所得金額調整控除申告書 | Kyuyo shotokusha no kiso kojo shinkokusho · haigusha kojo-to shinkokusho · shotoku kingaku chousei kojo shinkokusho | Basic Deduction / Spouse Deduction / Income Adjustment Deduction Declaration |

| 給与所得者の扶養控除等(異動)申告書 | Kyuyo shotokusha no fuyou kojo-to (idou) shinkokusho | Declaration of Dependent Deductions for Salary Earners |

| 給与所得者の保険料控除申告書 | Kyuyo shotokusha no hokenryo kojo shinkokusho | Insurance Premium Deduction Declaration |

In the sections below, we’ll go through each one step by step and explain how to fill them out.

Basic Deduction Declaration Form (基礎控除申告書, Kiso Koujo Shinkoku-sho)

As the name suggests, the Basic Deduction Declaration Form, or Kiso Koujo Shinkoku-sho (基礎控除申告書) is used to declare your eligibility for the basic income tax deduction. This deduction is a standard amount that reduces your taxable income, which in turn lowers (or increases) the income tax you owe.

We have broken down the form into five parts, but depending on your personal situation, you may only need to complete the first two sections. For example, if you don’t have a spouse or dependent relatives, and neither you nor your family members have disabilities, the remaining sections may be left blank!

1. Basic information

Perhaps the easiest and most straightforward section is the top part of the form, which asks for basic information about you and your employer. In most cases, your employer will also ask for the hojin bango (法人番号), or corporate number. Don’t worry. Your employer should be able to provide this information if you don’t already have it.

| Field | English | Explanation |

| 給与の支払者の名称(氏名) | Employer Name | This is the name of your employer doing, or the “salary payer.” |

| 給与の支払者の整理番号 | Corporate number | A unique number assigned to the employer for tax purposes. Your company should be able to provide them. |

| 給与の支払者の所在地 | Employer Address | The registered address of your employer. |

| フリガナ | Name (Furigana) | Space for the employee to write their name in katakana. |

| あなたの氏名 | Your name | Space for you to write your full name. |

| あなたの住所 | Your address | Space for the employee to write their current residential address. |

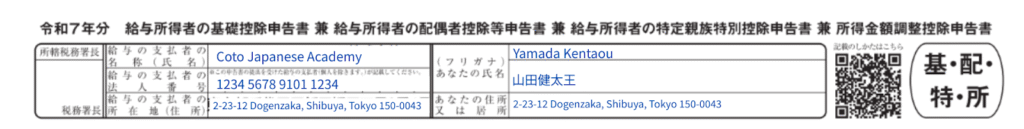

2. Your estimated total income for the year

Next comes the part where you need to do a bit of digging and some simple calculations: estimating your total income for the year. This includes both your previous income and your current income combined. Once you have your estimated total, you can calculate your after-tax income, which is then used to determine your basic deduction.

Tip: If you started a new job in Japan partway through the year, be sure to download all of your monthly pay slips. It makes it much easier to accurately fill out your year-end tax adjustment form.

| Field | English | Explanation |

| 給与所得(収入金額) | Your total salary before tax for this year (年収). | You can copy from your company’s estimate or your payslips. Usually written by the employer. |

| 給与所得(所得金額) | Net income | This is your net income after deductions such as taxes and insurance. |

| 給与所得以外の所得 | Salary from side income | Include side income coming from freelance work, part-time, or investment |

| 合計所得金額の見積額 | Total taxable income = salary income + side income. | If only salary, it should same as your salary taxable income. |

区分Ⅰ〜Ⅳ | Category based on income | 区分Ⅰ〜Ⅳ is your income category, which determines how much 基礎控除 (Basic deduction) you get. Look at your 合計所得金額 (total taxable income), then match it to the ranges. |

| 基礎控除の額 | Basic deduction amount | Find the corespondent amount of basic deduction based on your 区分. |

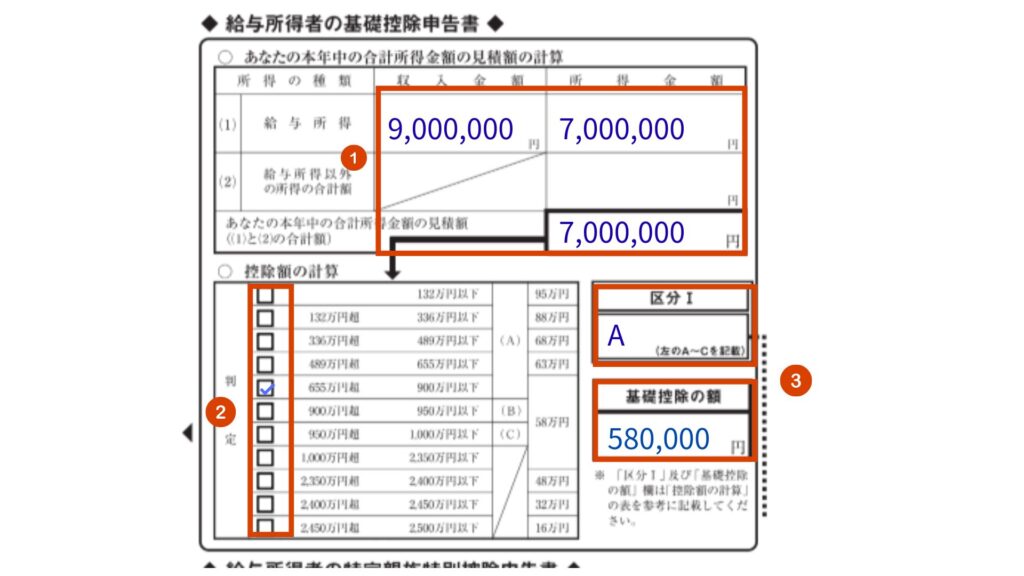

3. Spousal deduction declaration

Single individuals do not need to complete this section at all. One important thing to remember is that if both spouses are working, only one of you should fill out the form to avoid claiming the deduction twice.

| Field | Meaning | What You Write |

| 配偶者の氏名 | Full name of your spouse | Write the name in kanji/kana |

| 個人番号(マイナンバー) | Spouse’s MyNumber | Must be filled if claiming spousal deduction |

| 生年月日 | Date of birth | In Japanese format (YYYY/MM/DD) |

| 住所 | Spouse’s address | Only if different from yours |

| 給与所得(収入金額) | Your spouse’s total salary before tax (if working). | Write their annual income estimate. |

| 給与所得(所得金額) | Taxable income after deductions. | Usually leave blankyour employer calculates if needed. |

| 給与所得以外の所得 | The side income they earn. | Leave blank if none. |

| 合計所得金額 | Total taxable income | Sum of the above. |

区分Ⅰ〜Ⅳ | Category based on income | 区分Ⅰ〜Ⅳ is your income category, which determines how much 基礎控除 (Basic deduction) you get. Look at your 合計所得金額 (total taxable income), then match it to the ranges. |

| 配偶者控除の額 | Formal deduction amount | Match the amount of deduction estimation based on the category that applies to your spouse |

Determining your Spouse Deduction is slightly different from calculating your own deduction. Please check the following criteria.

| Field | Meaning | What You Do |

| (1) 58万円以下(扶養控除の対象) | Spouse taxable income ≤ 58万円 (full spousal deduction) | Check only if your spouse basically does not earn or earns very little |

| (2) 58万円超95万円以下 | Spouse’s taxable income between 58–95万円 | Check if spouse earns a small income |

| (3) 95万円超133万円以下 | Spouse’s taxable income between 95–133万円 | Check if spouse earns part-time but is still eligible for partial deduction |

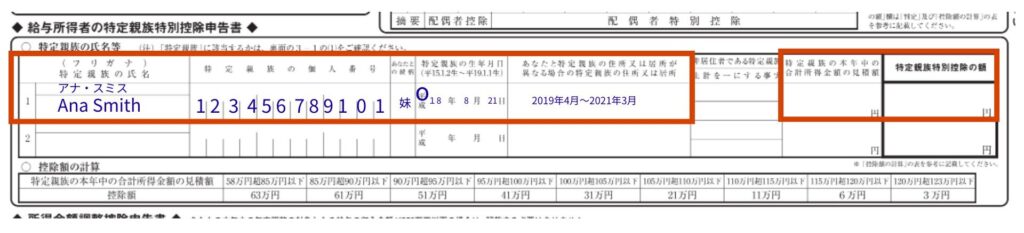

4. Special deduction for specific relatives of salaried employees

This section of the year-end tax adjustment in Japan form is for claiming a special deduction if you are supporting certain relatives who depend on you financially. These relatives usually include:

- Parents

- Grandparents

- Siblings (in some cases)

The purpose of this deduction is to reduce your taxable income if you financially support family members who meet specific criteria, such as having a low income or living with you.

If you would like to claim the Special Deduction for Specific Relatives, you must submit a Special Deduction for Specific Relatives Declaration Form.

- Enter the relative’s information

Fill in the name, personal identification number, relationship, date of birth, and other required details of the eligible relative. - Enter the relative’s estimated total income for the year

Calculate their estimated income using the Salary Income Calculation section, in the same way as you calculate income for the Basic Deduction for salaried employees. - Enter your own estimated income and the deduction amount

In the Deduction Calculation section, enter your estimated income amount and then fill in the corresponding deduction amount.

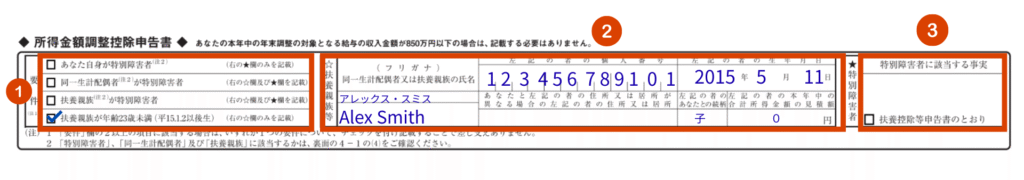

5. Income adjustment deduction declaration form

This section is used when you, your spouse, or a dependent relative is legally recognized as disabled, or Specially Disabled Persons (特別障害者, tokubetsu shougaisha).

You should check and fill out this section if any of the following apply:

- You are a specially disabled person

- Your spouse living in the same household is a specially disabled person

- Your dependent relatives qualify as specially disabled persons

- You have dependents under the age of 23

| Section | Explanation |

| 1 | Check all criteria that apply to your situation. |

| 2 | If the disabled individual is not you, enter their information: date of birth, MyNumber, your relationship to them, and their income. |

| 3 | Describe the specific facts or conditions that qualify you or your dependent as a specially disabled person. |

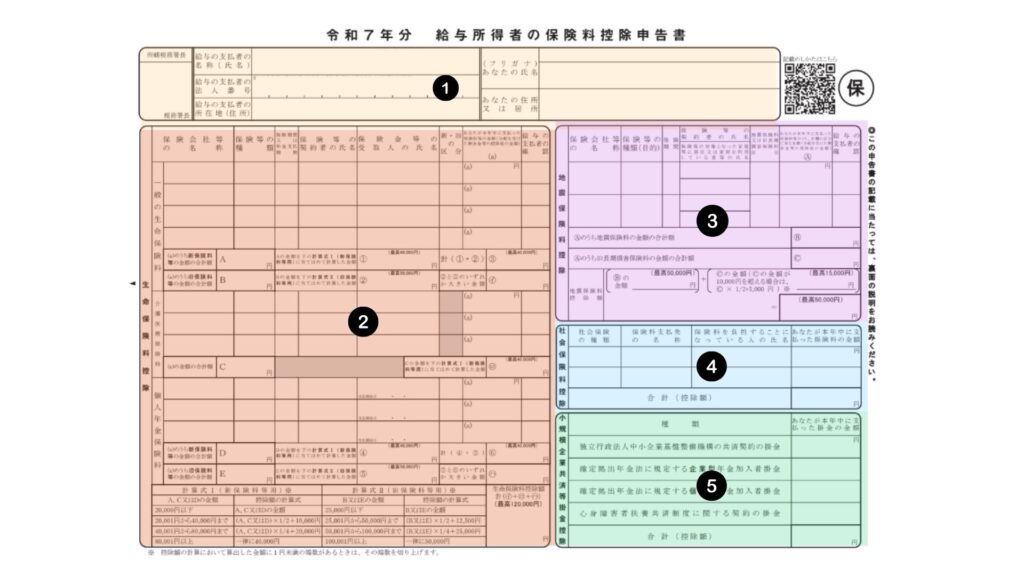

Application for Deduction for Insurance Premiums (保険料控除申告書, Hokenryou Koujo Shinkokusho)

A second form you will likely come across a form called 保険料控除申告書 (Hokenryou Koujo Shinkokusho), or Insurance Premium Deduction Declaration Form. At first glance, you might think, “Wait, doesn’t my company already handle my insurance?” — and in a way, they do.

Your company usually pays health insurance and pension contributions, but the deduction form is mainly for private insurance you pay yourself, not the mandatory social insurance. These are things like your extra life insurance or earthquake insurance policies you’ve signed up for independently.

Filling out the form ensures that these payments are recognized for tax deductions. If you skip it, the government won’t know you paid these premiums, and you could miss out on some savings!

If you don’t have any private insurance premiums to declare, you don’t need to fill out the 保険料控除申告書.

Below are the explanations of each section of the form.

| No. | 控除の種類 (Japanese) | Type of Deduction (English) |

| 1 | – | Basic inrofmraiton |

| 2 | 生命保険料控除 | Life insurance premium deduction |

| 3 | 地震保険料控除 | Earthquake insurance premium deduction |

| 4 | 社会保険料控除 | Social insurance premium deduction |

| 5 | 小規模企業共済等掛金控除 | Small business mutual aid premium deduction |

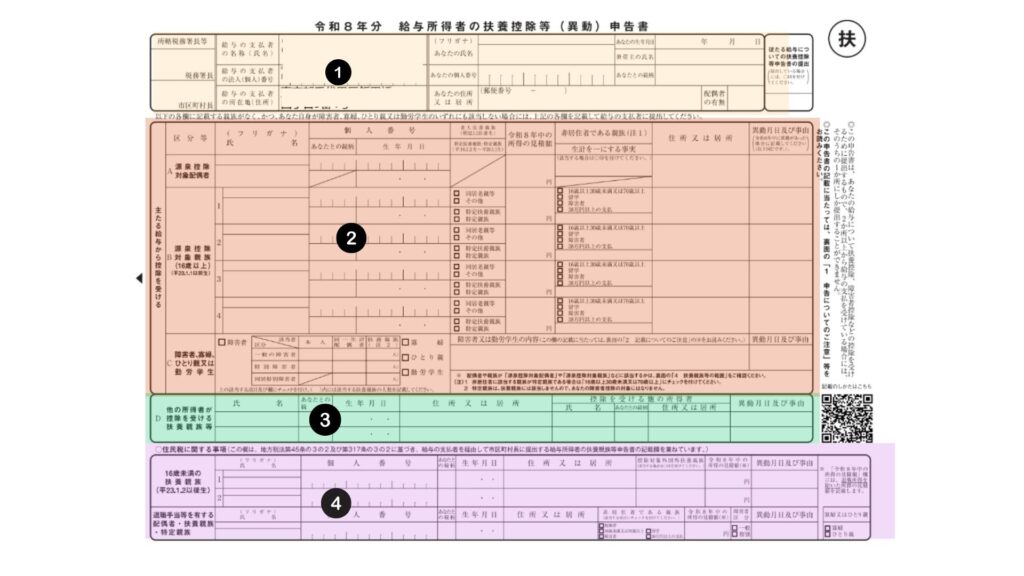

Dependent Deduction Declaration Form (扶養控除等申告書, Fuyou Koujotou Shinkokusho)

The final form in your year-end tax adjustment in Japan is about deductions for your dependents. This form helps your employer figure out how much money you can subtract from your taxable income for people you support financially, like:

- Children

- Spouses

- Other family members who qualify for special deductions

In simple terms, the more eligible dependents you have, the more money you can reduce from your taxable income, which usually means you pay less tax.

Even if you don’t have any dependents or a spouse eligible for deductions, you still need to submit this form, but you can only fill out the basic information and leave the rest section blank.

Here’s an overview of what each deduction is and who it applies to.

- If your spouse earns ¥580,000–¥1,330,000 and your income is ¥10 million or less

- If you have a relative (16+) living with you who earns ¥580,000 or less per year

- If you, your spouse, or a dependent is disabled

- If you are a widow and your income is ¥5 million or less

- If you are unmarried, have a child living with you, and your income is ¥5 million or less

- If you are a student with an income of ¥850,000 or less

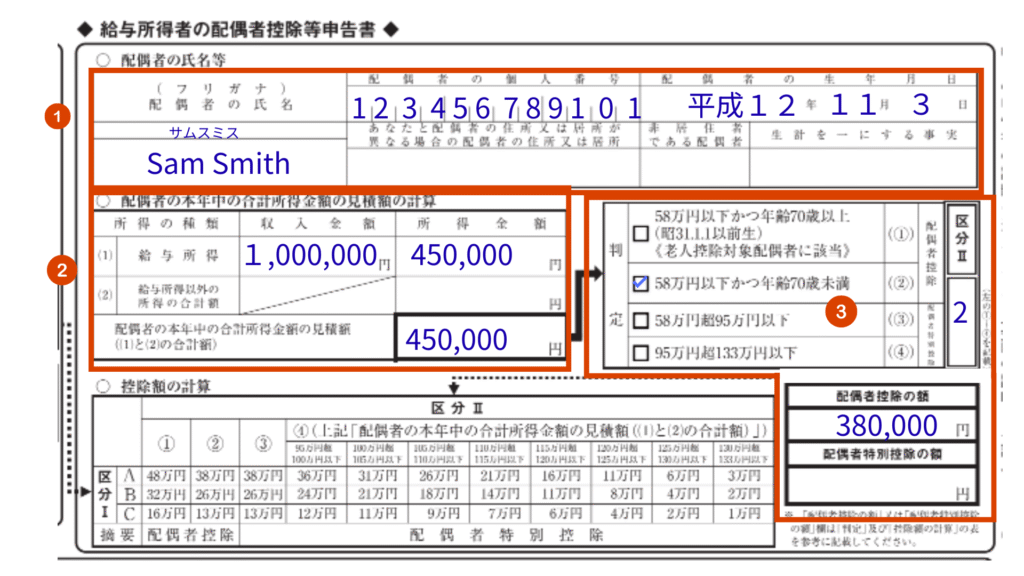

1. Basic Information

This is the section you’ll want to fill out no matter what, as it’s required for everyone. At this point, you might notice that the information feels repetitive. It asks for things like your employer’s name, corporate number, address, and your own personal details.

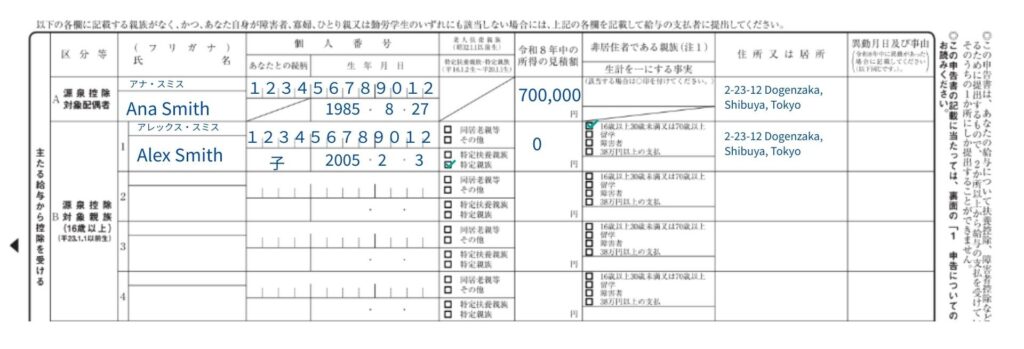

Below is an example of how to fill out this section, along with explanations for each field.

| Field (Japanese) | English Description |

| 給与の支払者の名称(氏名) | Name of employer (company) |

| 給与の支払者の法人(個人)番号 | Employer corporate/individual number |

| 給与の支払者の所在地(住所) | Employer address |

| フリガナ | Furigana (phonetic name) |

| あなたの氏名 | Your full name |

| あなたの個人番号 | MyNumber (individual number) |

| あなたの住所又は居所 | Your address |

| あなたの生年月日 | Your date of birth |

| 世帯主の氏名 | Name of head of household |

| 世帯主との続柄 | Relationship to head of household |

| 配偶者の有無 | Whether you have a spouse |

2. Spouse and dependent relative eligible for deduction

Next, let’s take a look at the Dependent Deduction Declaration Form, which covers two main areas:

- Spouse eligible for withholding tax deductions (often highlighted in red)

- Dependent relatives aged 16 or older who are eligible for deductions (often highlighted in blue)

The form asks for several pieces of information for each dependent, including their estimated income, address (if it is different from yours), and MyNumber ID.

According to the Income Tax Act, dependents eligible for deductions are officially determined based on their status as of December 31st of the tax year. However, in practice, year-end adjustments are completed when your final salary of the year is paid. This means that dependent and spouse deductions are calculated based on your dependents’ status on the day your last paycheck is issued.

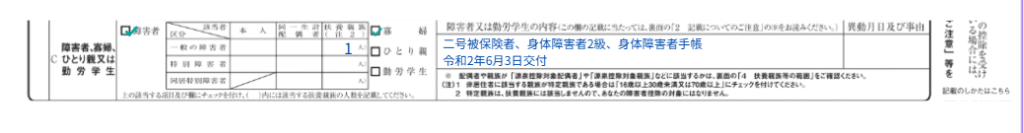

3. Deduction for the disabled, widows, single parents, and working students

If you fall into any of the following categories, make sure to check the box section of the form:

- The filer has a disability

- The filer is a widow

- The filer is a single parent

- The filer is a working student

- A spouse or dependent living in the same household has a disability

Once you check one or more boxes, you also need to further explain the details of your circumstances. If none applies to you, leave this section blank.

In our example, we wrote:

二号被保険者、身体障害者2級、身体障害者手帳

令和2年6月3日交付

Ni-gou hihokensha, shintai shougaisha nikyuu, shintai shougaisha techou

Reiwa ni-nen roku-gatsu mikka koufu

Category 2 insured person, Grade 2 physical disability, Physical Disability Certificate. Issued on June 3, 2020.

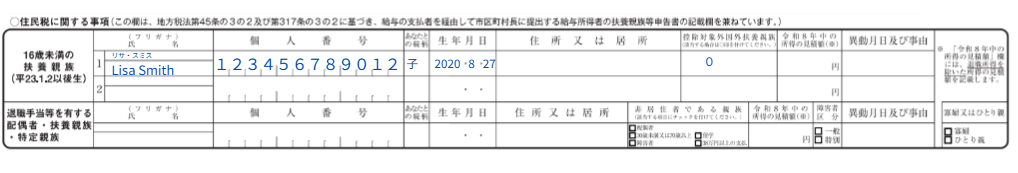

4. Resident Tax

The final part of the form deals with resident tax, and you only need to fill it out if you have dependents under the age of 16. If a dependent under 16 lives outside Japan, don’t forget to check the box for deductible overseas dependents.

One more thing: if a spouse or dependent who qualifies for deductions is expected to receive retirement income, make sure to enter their estimated income excluding retirement income.

What Documents Do Employees Need to Prepare for Nenmatsu Chosei?

We’ve covered several important forms you’ll need to complete or update as part of your year-end tax adjustment in Japan. In general, the simpler your personal situation — fewer dependents, no special disability benefits, fewer loans, or minimal insurance — the easier it is to fill out these forms.

But submitting these forms is not always enough. Often, you’ll also need to provide supporting documents as proof. Here are the most common documents required for year-end tax adjustment:

- Proof of Life Insurance Deduction

- Proof of Earthquake Insurance Deduction

- Receipt for National Health Insurance Premium Payment

- Proof of National Pension Premium Payment (postcard)

- Proof of Loan Balance (issued by your bank)

- Certificate of Special Deduction for Housing Loans

- Certificate of Small Enterprise Mutual Aid Premium Deduction

It’s important to note that you don’t need to submit all of these documents—only the ones that apply to your situation. These forms and certificates are relevant if you have changes or expenses that affect your tax deductions.

For example, if you’ve been paying for insurance, such as life insurance, earthquake insurance, or private health insurance, you’ll be required to fill out the corresponding insurance deduction form and provide proof of life insurance deduction, such as the certificate. If you took out a home loan this year, that may also affect your tax situation. In that case, you’ll have to complete an additional form to declare your housing loan deduction, perhaps your loan balance.

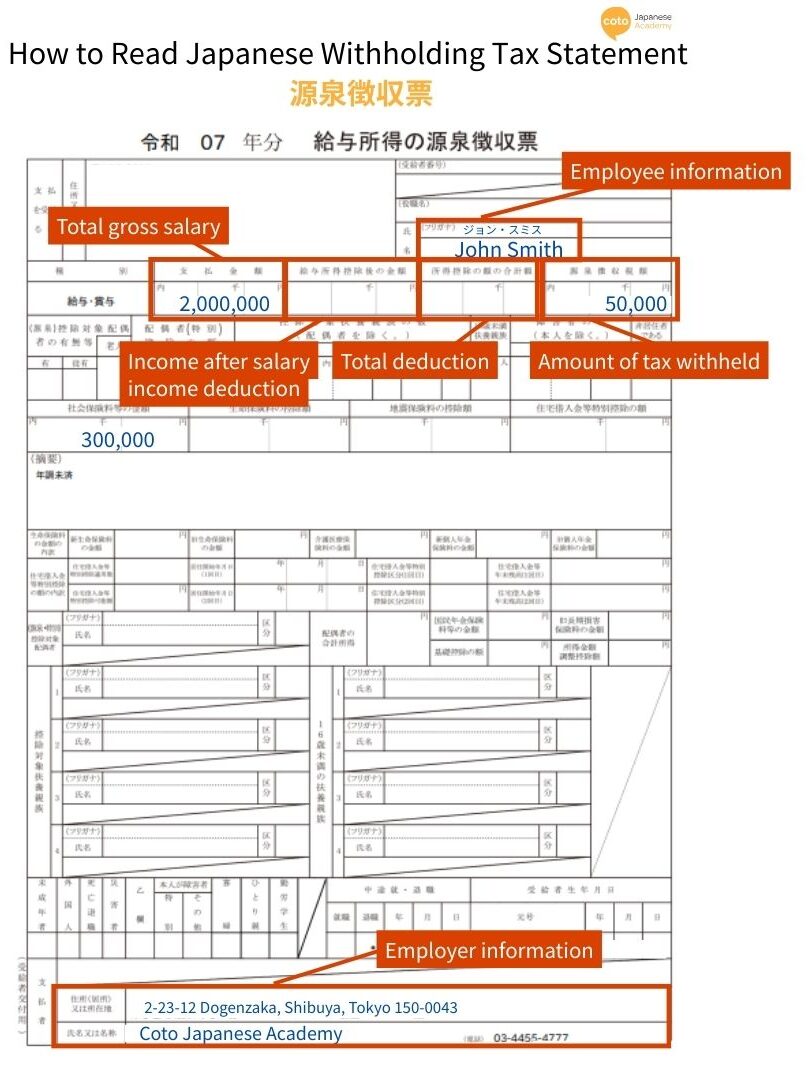

The Outcome: Receiving Your Gensen Choushuuhyo (Withholding Tax Statement)

So what will you get from all of this? Well, besides getting some part of your paid taxes return, there is one more important document you’ll receive at the end of the year: the gensen choushuuhyo (源泉徴収票), or withholding tax statement. This document summarizes your annual income and the taxes withheld by your employer — information you may need for everything from filing taxes to applying for loans.

The gensen choushuuhyo is usually issued between November and December, and it outlines key information, including your total salary for the year, the amount of income tax withheld, and any deductions processed by your employer.

If you happen to change jobs in the middle of the year, your current employer may ask you to submit the gensen choushuuhyo from your previous company as part of your year-end tax adjustment in Japan process. In those situations, these statements can be issued mid-year when needed, but they won’t be sent automatically — you must ask for them!

| Section | Japanese Label | What It Means |

| Total Amount Paid | 支払金額 (Shiharai Kingaku) | Your total gross salary for the year before taxes and deductions. |

| Income After Salary Deduction | 給与所得控除後の金額 (Kyuuyo Shotoku Koujo-go no Kingaku) | The amount of income remaining after Japan’s automatic salary income deduction. |

| Total Amount of Deductions | 所得控除の額の合計額 (Shoutoku Koujo no Gaku no Goukei-gaku) | Combined total of all deductions: insurance, dependents, social insurance, basic deduction, disability, housing loan, etc. |

| Total Tax Withheld | 源泉徴収税額 (Gensen Choushuu Zeigaku) | The total income tax withheld by your employer throughout the year. This determines if you get a refund or need to pay additional tax. |

Doing Taxes Isn’t Hard If You Know a Little Japanese!

This guide may have been long, but we hope it gave you a clear and complete picture of how year-end tax adjustments in Japan work. Taxes are overwhelming for most people — even more so when you’re navigating the process in a different language.

The good news is that many companies now provide English versions of tax adjustment forms, and your HR department is always there to help if you feel unsure. They’ve handled countless cases before, after all!

Still, there’s something empowering about understanding what you’re filling out. Even a basic understanding of Japanese can make the entire process faster, less stressful, and far more approachable.

This is where learning Japanese at Coto Academy comes in. At Coto, you don’t just learn casual conversation — you gain practical language skills that help with real-life situations, including reading forms, understanding official documents, and confidently handling administrative tasks like taxes.

By learning Japanese with Coto Academy, you can:

- Navigate day-to-day tasks without constantly relying on translations

- Understand official documents like the withholding tax slip and insurance forms

- Communicate confidently with your coworkers

In short, learning Japanese at Coto Academy makes your life in Japan easier and more independent.

Why join Coto Academy?

- Small classrooms with only up to 8 students for personalized support

- Professional native Japanese teachers, all trained to help you succeed

- Over 60 different Japanese classes across 18 levels, tailored to your needs

- School locations in Shibuya, Minato, Iidabashi, and Yokohama, plus a fully online Japanese language school, so that you can learn anywhere, anytime!

Ready to get started? Simply fill out the form below, and our friendly staff will get back to you!

FAQ

What is nenmatsu chosei?

Nenmatsu chosei is the year-end tax adjustment in Japan, where employers reconcile an employee’s income tax for the year to ensure the correct amount is withheld based on income and deductions.

What happens if I miss the tax deadline in Japan?

Missing the tax deadline can lead to penalties or interest on unpaid taxes, so it’s important to submit your tax return or adjustment as soon as possible.

Who needs to do nenmatsu chosei?

Most employees in Japan who receive a salary through an employer automatically go through nenmatsu chosei, while freelancers or self-employed people usually file a separate final tax return.

What documents are needed for nenmatsu chosei?

The main documents include the Declaration of Dependent Deductions, Insurance Premium Deduction Declaration, and Basic/Spouse Deduction Declarations.

When is year-end tax adjustment in Japan?

Nenmatsu chosei is usually processed by employers between November and December, with adjustments reflected in the December or January paycheck.